434

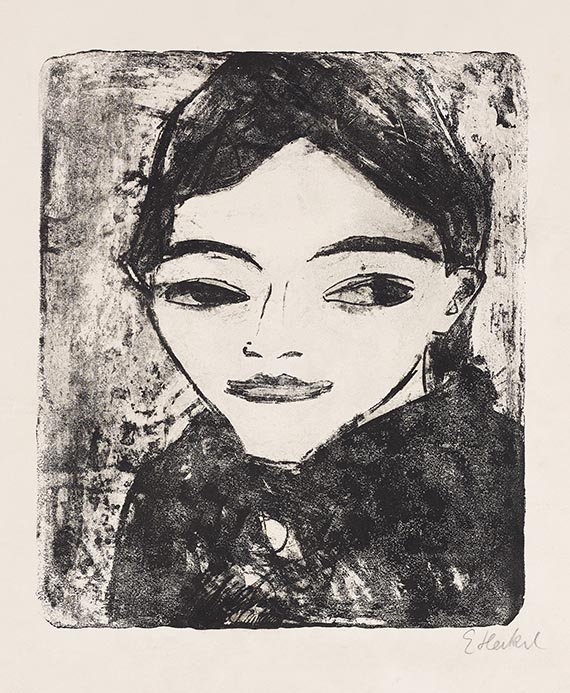

Erich Heckel

Fränzi, 1910.

Lithograph

Estimate:

€ 10,000 / $ 11,800 Sold:

€ 33,020 / $ 38,963 (incl. surcharge)

Fränzi. 1910.

Lithograph.

Ebner/Gabelmann 441 L. Dube L 142. Signed. One of 4 known copies. On wove paper. 32.8 x 27.4 cm (12.9 x 10.7 in). Sheet: 46,2 x 35,3 cm (18,1 x 13,8 in).

[AR].

• One of to date only 4 known copies.

• Heckel portrayed Fränzi, the most famous of the "Brücke" models.

• From 1910, a key year for the artist group.

PROVENANCE: Lübeck, Museum Behnhaus (1924-1937).

State.owned (1937-1940, "Degenerate Art", number 11584).

Galerie Ferdinand Möller, Berlin (in an exchange with the above in 1940, until 1943).

Ferdinand Möller, Zermützel/Cologne (1943–1956).

Maria Möller-Garny, Cologne (1956–1983).

Art dealer Wolfgang Wittrock, Düsseldorf.

Corporate Collection Ahlers AG, Herford (acquired from the above in 1984).

EXHIBITION: Der Blick auf Fränzi und Marcella: Zwei Modelle der Brücke-Künstler Heckel, Kirchner und Pechstein, Sprengel Museum, Hanover, August 29, 2010 - January 9, 2011, cat. no. 123, p. 51 (fig.) and 135.

Schwarz auf Weiß. Druck-Graphik im Wandel der Zeit von Rembrandt bis Dieter Roth, Foundation Ahlers Pro Arte / Kestner Pro Arte, Hanover, September 28, 2013 - January 5, 2014.

Blaues Land und Großstadtlärm. Ein expressionistischer Spaziergang durch Kunst und Literatur, Franz Marc Museum, Kochel am See, April 30 - October 3, 2017, cat. p. 152.

Erich Heckel. Der poetische Expressionist, Franz Marc Museum, Kochel am See, February 24 - May 19, 2019.

LITERATURE: Galerie Wolfgang Ketterer, 20. Jahrhundert, 58th auction, June 7/8, 1982, lot 685 (illu.).

www.geschkult.fu-berlin.de/e/db_entart_kunst/datenbank (Nr. 11584).

Lithograph.

Ebner/Gabelmann 441 L. Dube L 142. Signed. One of 4 known copies. On wove paper. 32.8 x 27.4 cm (12.9 x 10.7 in). Sheet: 46,2 x 35,3 cm (18,1 x 13,8 in).

[AR].

• One of to date only 4 known copies.

• Heckel portrayed Fränzi, the most famous of the "Brücke" models.

• From 1910, a key year for the artist group.

PROVENANCE: Lübeck, Museum Behnhaus (1924-1937).

State.owned (1937-1940, "Degenerate Art", number 11584).

Galerie Ferdinand Möller, Berlin (in an exchange with the above in 1940, until 1943).

Ferdinand Möller, Zermützel/Cologne (1943–1956).

Maria Möller-Garny, Cologne (1956–1983).

Art dealer Wolfgang Wittrock, Düsseldorf.

Corporate Collection Ahlers AG, Herford (acquired from the above in 1984).

EXHIBITION: Der Blick auf Fränzi und Marcella: Zwei Modelle der Brücke-Künstler Heckel, Kirchner und Pechstein, Sprengel Museum, Hanover, August 29, 2010 - January 9, 2011, cat. no. 123, p. 51 (fig.) and 135.

Schwarz auf Weiß. Druck-Graphik im Wandel der Zeit von Rembrandt bis Dieter Roth, Foundation Ahlers Pro Arte / Kestner Pro Arte, Hanover, September 28, 2013 - January 5, 2014.

Blaues Land und Großstadtlärm. Ein expressionistischer Spaziergang durch Kunst und Literatur, Franz Marc Museum, Kochel am See, April 30 - October 3, 2017, cat. p. 152.

Erich Heckel. Der poetische Expressionist, Franz Marc Museum, Kochel am See, February 24 - May 19, 2019.

LITERATURE: Galerie Wolfgang Ketterer, 20. Jahrhundert, 58th auction, June 7/8, 1982, lot 685 (illu.).

www.geschkult.fu-berlin.de/e/db_entart_kunst/datenbank (Nr. 11584).

434

Erich Heckel

Fränzi, 1910.

Lithograph

Estimate:

€ 10,000 / $ 11,800 Sold:

€ 33,020 / $ 38,963 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 434

Lot 434