205

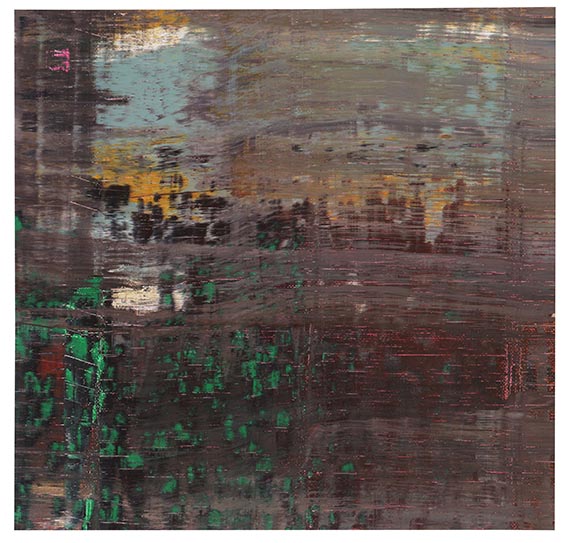

Gerhard Richter

15. Nov. 1996 (Teil des verworfenen Abstrakten Bildes 802-4), 1996.

Oil on canvas, firmly laid on a backing cardboard

Estimate:

€ 60,000 / $ 70,800 Sold:

€ 57,150 / $ 67,437 (incl. surcharge)

15. Nov. 1996 (Teil des verworfenen Abstrakten Bildes 802-4). 1996.

Oil on canvas, firmly laid on a backing cardboard.

Signed and dated in lower left of backing. Lower right monogrammed. Inscribed "8" on the reverse. 23.4 x 24 cm (9.2 x 9.4 in). Backing cardboard: 42 x 29,6 cm (16,5 x 11,6 in).

[AW].

• Fragment of the destroyed painting "Abstraktes Bild" from 1994.

• Richter places the emphasis of his works on the process of creation rather than the result.

• By cutting it up, each piece becomes a new work of his so-called planned spontaneity.

• In 2020, Richter declared his artistic oeuvre complete.

PROVENANCE: Private collection Northern Germany.

LITERATURE: Cf. online catalogue raisonné, no. 802-4.

Hans-Ulrich Obrist (ed.), Gerhard Richter. 100 Bilder, Ostfildern-Ruit 1996, no p. (color illu.).

"Accepting that I can't plan anything. Every consideration I make about the construction of a picture is wrong, and if the execution succeeds, it is only because I partially destroy it or because it works anyway [..]. The only consolation is that I can say to myself that I made the pictures anyway, even if they do what they want, against my will, but still somehow come into being [..]."

Gerhard Richter, quoted from: Armin Zweite, Sehen, Reflektieren, Erscheinen. Anmerkungen zum Werk von Gerhard Richter, in: Kunstsammlung Nordrhein-Westfalen (ed.), Gerhard Richter, Düsseldorf 2005, p. 83.

Oil on canvas, firmly laid on a backing cardboard.

Signed and dated in lower left of backing. Lower right monogrammed. Inscribed "8" on the reverse. 23.4 x 24 cm (9.2 x 9.4 in). Backing cardboard: 42 x 29,6 cm (16,5 x 11,6 in).

[AW].

• Fragment of the destroyed painting "Abstraktes Bild" from 1994.

• Richter places the emphasis of his works on the process of creation rather than the result.

• By cutting it up, each piece becomes a new work of his so-called planned spontaneity.

• In 2020, Richter declared his artistic oeuvre complete.

PROVENANCE: Private collection Northern Germany.

LITERATURE: Cf. online catalogue raisonné, no. 802-4.

Hans-Ulrich Obrist (ed.), Gerhard Richter. 100 Bilder, Ostfildern-Ruit 1996, no p. (color illu.).

"Accepting that I can't plan anything. Every consideration I make about the construction of a picture is wrong, and if the execution succeeds, it is only because I partially destroy it or because it works anyway [..]. The only consolation is that I can say to myself that I made the pictures anyway, even if they do what they want, against my will, but still somehow come into being [..]."

Gerhard Richter, quoted from: Armin Zweite, Sehen, Reflektieren, Erscheinen. Anmerkungen zum Werk von Gerhard Richter, in: Kunstsammlung Nordrhein-Westfalen (ed.), Gerhard Richter, Düsseldorf 2005, p. 83.

205

Gerhard Richter

15. Nov. 1996 (Teil des verworfenen Abstrakten Bildes 802-4), 1996.

Oil on canvas, firmly laid on a backing cardboard

Estimate:

€ 60,000 / $ 70,800 Sold:

€ 57,150 / $ 67,437 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 205

Lot 205