210

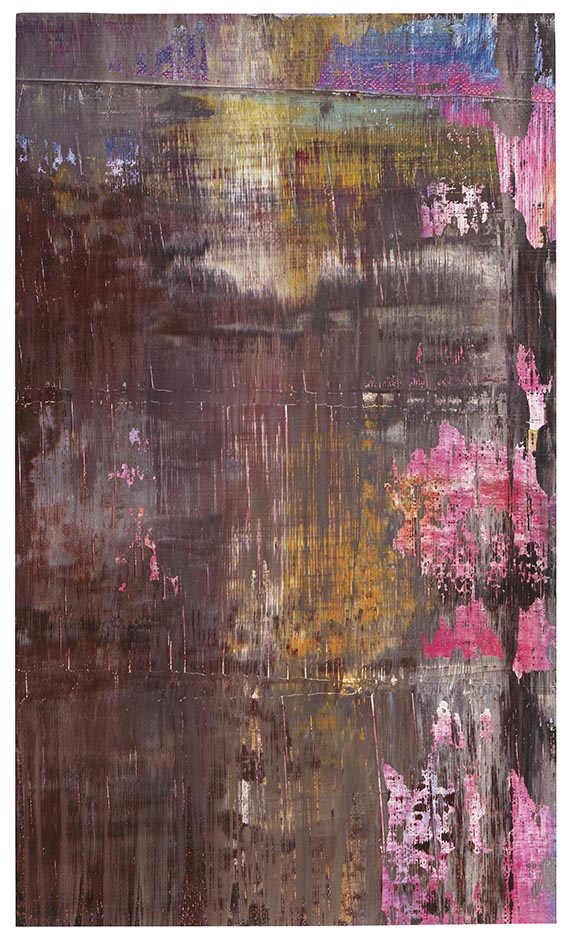

Gerhard Richter

11 Nov. 1996 (Teil des verworfenen Abstrakten Bildes 802-4), 1996.

Oil on canvas, firmly laid on a backing

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 50,800 / $ 59,944 (incl. surcharge)

11 Nov. 1996 (Teil des verworfenen Abstrakten Bildes 802-4). 1996.

Oil on canvas, firmly laid on a backing.

Signed and dated on the backing in lower left. Lower right monogrammed. Inscribed "7" on the reverse. 28.7 x 17 cm (11.2 x 6.6 in). Backing: 42 x 29,7 cm (16,5 x 11,6 in).

[AW].

• Fragment of the destroyed painting "Abstraktes Bild" from 1994.

• Things are destroyed to make room for new creation.

• Richter's legendary squeegee technique leads to impressive depictions of the obscure.

• Gerhard Richter has been one of the most world's best-paid contemporary artists for many years.

PROVENANCE: Private collection Northern Germany.

LITERATURE: Cf. online catalogue raisonné, no. 802-4.

Hans-Ulrich Obrist (ed.), Gerhard Richter. 100 Bilder, Ostfildern-Ruit 1996, no p. (color illu.).

"I don't have a specific image in mind, I want to end up with an image that I hadn't planned at all. So, this method of working with arbitrariness, chance, inspiration and destruction allows a certain type of picture to emerge, but never a predetermined one. The respective picture should develop from a painterly or visual logic, emerge as if inevitably."

Gerhard Richter in a conversation with Interview 1990, 1990

Oil on canvas, firmly laid on a backing.

Signed and dated on the backing in lower left. Lower right monogrammed. Inscribed "7" on the reverse. 28.7 x 17 cm (11.2 x 6.6 in). Backing: 42 x 29,7 cm (16,5 x 11,6 in).

[AW].

• Fragment of the destroyed painting "Abstraktes Bild" from 1994.

• Things are destroyed to make room for new creation.

• Richter's legendary squeegee technique leads to impressive depictions of the obscure.

• Gerhard Richter has been one of the most world's best-paid contemporary artists for many years.

PROVENANCE: Private collection Northern Germany.

LITERATURE: Cf. online catalogue raisonné, no. 802-4.

Hans-Ulrich Obrist (ed.), Gerhard Richter. 100 Bilder, Ostfildern-Ruit 1996, no p. (color illu.).

"I don't have a specific image in mind, I want to end up with an image that I hadn't planned at all. So, this method of working with arbitrariness, chance, inspiration and destruction allows a certain type of picture to emerge, but never a predetermined one. The respective picture should develop from a painterly or visual logic, emerge as if inevitably."

Gerhard Richter in a conversation with Interview 1990, 1990

210

Gerhard Richter

11 Nov. 1996 (Teil des verworfenen Abstrakten Bildes 802-4), 1996.

Oil on canvas, firmly laid on a backing

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 50,800 / $ 59,944 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 210

Lot 210