367

Friedrich Schröder-Sonnenstern

Die moralische Schwanenbeschwörung, 1956.

Colored pencil drawing

Estimate:

€ 14,000 / $ 16,520 Sold:

€ 17,780 / $ 20,980 (incl. surcharge)

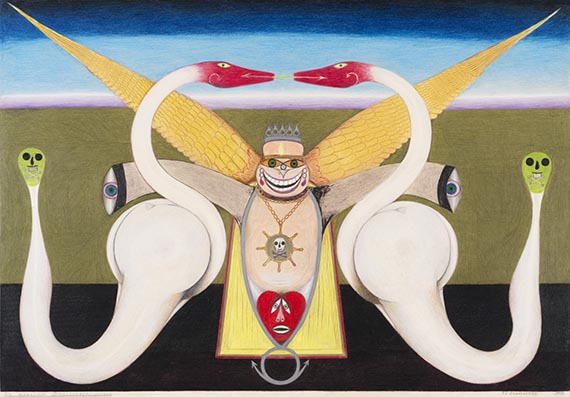

Die moralische Schwanenbeschwörung. 1956.

Colored pencil drawing.

Signed and dated lower right, titled lower left. Monogrammed and dated on the reverse. On smooth cardboard. 49 x 70.8 cm (19.2 x 27.8 in), size of sheet. [EH].

• Until the mid-1950s, Friedrich Schröder-Sonnenstern drew almost exclusively with pencil, and only began using colored crayons thereafter.

• Shown at the Schröder-Sonnenstern retrospective at the Kestner Gesellschaft in 1973.

• The mythology of his imagery is as complex as his life was diverse.

PROVENANCE: Carl Laszlo Collection, Basel.

From a Swiss collection.

EXHIBITION: Friedrich Schröder-Sonnenstern, Kestner-Gesellschaft Hanover, June 8 - July 1, 1973, cat. no. 124 (with a label and the catalog entry attached to the reverse).

Wundersame Welten. Von René Magritte bis Daniel Richter, Museum im Kleihues-Bau, Kornwestheim, May 13 - September 24, 2023.

Colored pencil drawing.

Signed and dated lower right, titled lower left. Monogrammed and dated on the reverse. On smooth cardboard. 49 x 70.8 cm (19.2 x 27.8 in), size of sheet. [EH].

• Until the mid-1950s, Friedrich Schröder-Sonnenstern drew almost exclusively with pencil, and only began using colored crayons thereafter.

• Shown at the Schröder-Sonnenstern retrospective at the Kestner Gesellschaft in 1973.

• The mythology of his imagery is as complex as his life was diverse.

PROVENANCE: Carl Laszlo Collection, Basel.

From a Swiss collection.

EXHIBITION: Friedrich Schröder-Sonnenstern, Kestner-Gesellschaft Hanover, June 8 - July 1, 1973, cat. no. 124 (with a label and the catalog entry attached to the reverse).

Wundersame Welten. Von René Magritte bis Daniel Richter, Museum im Kleihues-Bau, Kornwestheim, May 13 - September 24, 2023.

367

Friedrich Schröder-Sonnenstern

Die moralische Schwanenbeschwörung, 1956.

Colored pencil drawing

Estimate:

€ 14,000 / $ 16,520 Sold:

€ 17,780 / $ 20,980 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 367

Lot 367