381

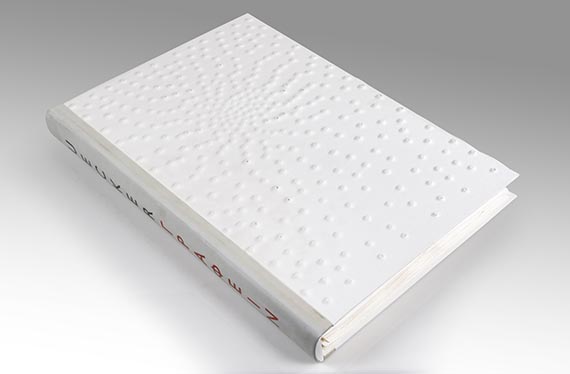

Günther Uecker

Graphein, 2002.

Book in 42 parts with 12 embossed prints in the...

Estimate:

€ 20,000 / $ 23,600 Sold:

€ 38,100 / $ 44,958 (incl. surcharge)

Graphein. 2002.

Book in 42 parts with 12 embossed prints in the original plexiglass slipcase.

Signed and dated in the imprint, each of the 12 embossed prints is signed, dated and numbered. From an edition of 10 Roman numbered copies. Embossing prints on firm handmade wove paper. Prints: 70 x 50 cm (27.5 x 19.6 in), each size of sheet. Slipcase:

Typographic design by Hans-Peter Willberg. Published by Dorothea van der Koelen, Mainz, and Edouard Weiss, Paris, 2022. Lacking the 3 sheets of texts by Günter Uecker. [EH].

• Günther Uecker celebrates writing as an act of painting and drawing at the same time.

• The twelve large-format prints transfer his nail fields' highly dynamic structure of movement to a print medium.

• Günther Uecker took part in documenta II and IV in 1964 and 1968.

PROVENANCE: Private collection, Baden-Württemberg.

LITERATURE: Dorothea und Martin van der Koelen, Günther Uecker. Opus Liber. Verzeichnis der bibliophilen Bücher und Werke 1960-2005, ed. by Britta Julia Dombrowe, Mainz 2007, no. L 0203.

Book in 42 parts with 12 embossed prints in the original plexiglass slipcase.

Signed and dated in the imprint, each of the 12 embossed prints is signed, dated and numbered. From an edition of 10 Roman numbered copies. Embossing prints on firm handmade wove paper. Prints: 70 x 50 cm (27.5 x 19.6 in), each size of sheet. Slipcase:

Typographic design by Hans-Peter Willberg. Published by Dorothea van der Koelen, Mainz, and Edouard Weiss, Paris, 2022. Lacking the 3 sheets of texts by Günter Uecker. [EH].

• Günther Uecker celebrates writing as an act of painting and drawing at the same time.

• The twelve large-format prints transfer his nail fields' highly dynamic structure of movement to a print medium.

• Günther Uecker took part in documenta II and IV in 1964 and 1968.

PROVENANCE: Private collection, Baden-Württemberg.

LITERATURE: Dorothea und Martin van der Koelen, Günther Uecker. Opus Liber. Verzeichnis der bibliophilen Bücher und Werke 1960-2005, ed. by Britta Julia Dombrowe, Mainz 2007, no. L 0203.

381

Günther Uecker

Graphein, 2002.

Book in 42 parts with 12 embossed prints in the...

Estimate:

€ 20,000 / $ 23,600 Sold:

€ 38,100 / $ 44,958 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 381

Lot 381