373

Andy Warhol

Goethe, 1982.

Pencil drawing

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 43,180 / $ 50,952 (incl. surcharge)

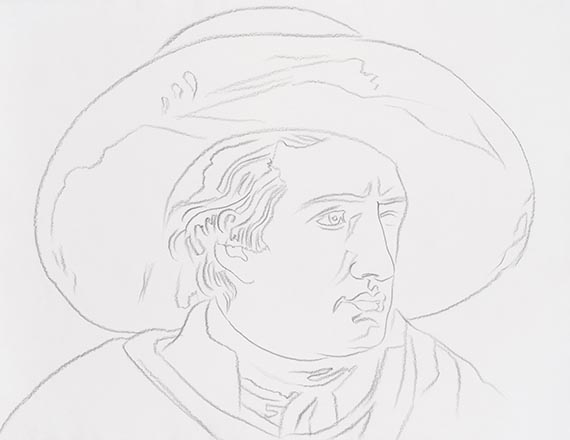

Goethe. 1982.

Pencil drawing.

With the estate stamp and the handwritten number “115.145”, as well as with the handwritten inscription “VF” on the reverse. On firm paper (with watermark "HMP"). 75.5 x 102.5 cm (29.7 x 40.3 in), size of sheet.

From June 9 to October 6 this year, a major exhibition at the Neue Nationalgalerie in Berlin celebrated Warhol's Pop Art portraits. [CH].

• The star of American Pop Art portrays an icon of world literature.

• His portraits of celebrities are among Andy Warhol's most famous works.

• Warhol based the present portrait on J. H. W. Tischbein's 1787 painting on display at the Städel Museum. He became acquainted with the painting on a visit to Frankfurt in 1980.

• Warhol rendered the motif with clear, bold lines in an almost life-size drawing.

• Intentional rather than spontaneous: The drawing does not have the fleeting quality of a swiftly jotted sketch. Instead, it results from an intensive examination of Warhol's artistic ideas.

• He would later work with the motif in large-format depictions on canvas and a famous series of serigraphs.

• In 2019, the New York Academy of Art presented an exhibition of his drawings entitled “Andy Warhol: By Hand,” which drew increased attention to the medium.

PROVENANCE: From the artist's estate (with estate stamp on the reverse).

Private collection, Germany.

Acquired from the above by the current owner.

LITERATURE: Jörg Schellmann (ed.), Andy Warhol. Unique, Munich 2014, p. 64 (illustrated).

Pencil drawing.

With the estate stamp and the handwritten number “115.145”, as well as with the handwritten inscription “VF” on the reverse. On firm paper (with watermark "HMP"). 75.5 x 102.5 cm (29.7 x 40.3 in), size of sheet.

From June 9 to October 6 this year, a major exhibition at the Neue Nationalgalerie in Berlin celebrated Warhol's Pop Art portraits. [CH].

• The star of American Pop Art portrays an icon of world literature.

• His portraits of celebrities are among Andy Warhol's most famous works.

• Warhol based the present portrait on J. H. W. Tischbein's 1787 painting on display at the Städel Museum. He became acquainted with the painting on a visit to Frankfurt in 1980.

• Warhol rendered the motif with clear, bold lines in an almost life-size drawing.

• Intentional rather than spontaneous: The drawing does not have the fleeting quality of a swiftly jotted sketch. Instead, it results from an intensive examination of Warhol's artistic ideas.

• He would later work with the motif in large-format depictions on canvas and a famous series of serigraphs.

• In 2019, the New York Academy of Art presented an exhibition of his drawings entitled “Andy Warhol: By Hand,” which drew increased attention to the medium.

PROVENANCE: From the artist's estate (with estate stamp on the reverse).

Private collection, Germany.

Acquired from the above by the current owner.

LITERATURE: Jörg Schellmann (ed.), Andy Warhol. Unique, Munich 2014, p. 64 (illustrated).

373

Andy Warhol

Goethe, 1982.

Pencil drawing

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 43,180 / $ 50,952 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 373

Lot 373