311

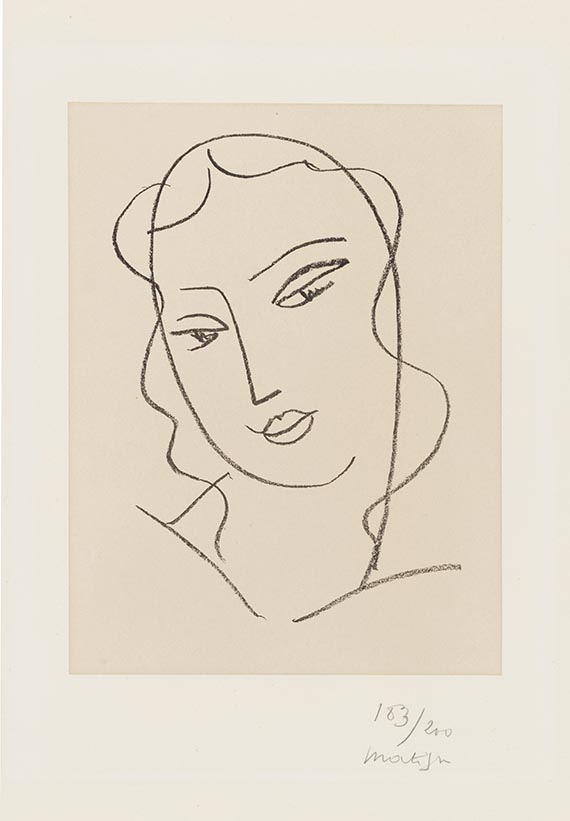

Henri Matisse

Tête voilée, 1950-1951.

Lithograph

Estimate:

€ 8,000 / $ 9,440 Sold:

€ 7,500 / $ 8,850 (incl. surcharge)

Henri Matisse

Etudes pour la Vierge "Tête voilée". Orig.-Lithographie. Signiert und numeriert. 1950/51. Aufgewalztes China auf starkem Vélin. Darstellung 28 : 21 cm. Papierformat 50 : 38 cm.

Späte, auf die Reinheit der Linie reduzierte Lithographie aus einer Reihe von Entwürfen, die Matisse für die Kapelle von Vence schuf.

1 von 200 numerierten Exemplaren. - Matisse konzentriert sich in seinen rund 800 Druckgraphiken im Wesentlichen auf Porträts und weibliche Aktdarstellungen.

- ZUSTAND: Entlang der Blattränder minimal gebräunt und im Passepartoutausschnitt lichtrandig, linker Blattrand mit 4 minim. Läsuren, verso an 2 Stellen unter Passepartout montiert.

LITERATUR: Duthuit 641.

1 of 200 numb. copies. Late lithograph from a series of sketches created by Matisse for the Chapel of Vence. Orig. lithograph. Signed and numbered. Rolled China on strong wove paper. Illustration 28 : 21 cm. Paper size 50: 38 cm. - Minimally browned along the edges of the sheet and light-stained in the passe-partout cutout, left edge of the sheet with 4 minimal damages, mounted under passe-partout in 2 places on verso.

Etudes pour la Vierge "Tête voilée". Orig.-Lithographie. Signiert und numeriert. 1950/51. Aufgewalztes China auf starkem Vélin. Darstellung 28 : 21 cm. Papierformat 50 : 38 cm.

Späte, auf die Reinheit der Linie reduzierte Lithographie aus einer Reihe von Entwürfen, die Matisse für die Kapelle von Vence schuf.

1 von 200 numerierten Exemplaren. - Matisse konzentriert sich in seinen rund 800 Druckgraphiken im Wesentlichen auf Porträts und weibliche Aktdarstellungen.

- ZUSTAND: Entlang der Blattränder minimal gebräunt und im Passepartoutausschnitt lichtrandig, linker Blattrand mit 4 minim. Läsuren, verso an 2 Stellen unter Passepartout montiert.

LITERATUR: Duthuit 641.

1 of 200 numb. copies. Late lithograph from a series of sketches created by Matisse for the Chapel of Vence. Orig. lithograph. Signed and numbered. Rolled China on strong wove paper. Illustration 28 : 21 cm. Paper size 50: 38 cm. - Minimally browned along the edges of the sheet and light-stained in the passe-partout cutout, left edge of the sheet with 4 minimal damages, mounted under passe-partout in 2 places on verso.

311

Henri Matisse

Tête voilée, 1950-1951.

Lithograph

Estimate:

€ 8,000 / $ 9,440 Sold:

€ 7,500 / $ 8,850 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 311

Lot 311